A consultation to create a register of beneficial ownership was carried out by the UK Government in 2018, with the aim of having the Register go “live” in 2021. The Russian invasion of Ukraine earlier this year was the catalyst to fast-track the draft legislation through parliament in a matter of weeks.

The Economic Crime (Transparency and Enforcement) Act 2022 (the “Act”) received Royal Assent on 15 March 2022 and introduced the framework for a UK register of overseas entities which hold interests in UK real estate. It is hoped that the transparency of the register will enable law enforcement agencies to investigate suspicious wealth more effectively.

A recent announcement by the UK Government confirmed that they intend for the Act to take effect and the Register of Overseas Entities be opened at 9am on 1 August 2022, with the land registration elements coming into force on 5 September 2022.

What is the Register of Overseas Entities (‘ROE’)?

- The register is designed to provide details of the beneficial owners of all overseas entities which own property in the UK.

- It will apply to “qualifying estates” of both commercial and residential property.

- The register will be publicly accessible and maintained at Companies House.

What is an Overseas Entity?

- A legal entity that is governed by the law of a country or territory outside the United Kingdom.

- This includes companies registered in Jersey, Guernsey and Isle of Man.

- A “legal entity” includes bodies corporate, partnerships or other entities that are considered a legal person under the law by which they are governed.

Who is a beneficial owner?

A beneficial owner is someone who satisfies one or more of the following conditions:

- holds more than 25% of the shares in an overseas entity;

- holds more than 25% of the voting rights in an overseas entity;

- holds the right to appoint or remove a majority of the board of directors of an overseas entity;

- has the right to exercise significant influence or control over an overseas entity;

- the trustees of a trust, or the members of a partnership, unincorporated association or other entity, that is not a legal person under the law by which it is governed meet any of the conditions specified above in relation to the overseas entity; and has the right to exercise significant influence or control over the activities of that trust or entity.

What are the new rules on overseas entities under the Act?

Provision of details

Overseas entities will need to provide basic details about the entity, including:

– name;

– country of incorporation/formation;

– registered/principal office;

– service address;

– legal form and applicable governing law;

– details of any overseas public register which it is entered on;

– any registration number.

Overseas Entity ID

If an application to register by an overseas entity is accepted, the overseas entity and its beneficial owners will be added to the ROE.

The overseas entity will also be provided with an Overseas Entity ID, which must be given to the appropriate land registry whenever the entity buys, sells or transfers land or property in the UK.

Provision of annual updates to the details

The Act requires overseas entities to provide updated statements 12 months after the overseas entity is registered, and every 12 months thereafter.

Refusal to register land transactions if entities are unregistered

If an overseas entity is not registered in the ROE at the time of a land transaction, the UK Land Registries are bound by the Act to refuse to register the deed effecting the transaction.

When does the Act come into force?

The Act became effective and the ROE launched at 9am on 1 August 2022.

The land registration elements are expected to come into force on 5 September 2022.

Does the Act have retrospective effect?

- For overseas entities who already hold interests in land

- from 1 January 1999 in England and Wales;

- from 8 December 2014 in Scotland;

they will be given a transition period of 6 months from the date of the commencement of the Act to register in the ROE, with a deadline of 31 January 2023.

- In Northern Ireland, the rules will only affect interests held in land from when the land registration rules of the Act come into force – 5 September 2022.

- However, if any overseas entity has disposed of land in any UK jurisdiction at any time since 28 February 2022 (or does so at any time before the 6-month transition period), the entity must register by the deadline of 31 January 2023. An offence will be committed if the entity fails to comply.

Are the rules the same across the UK jurisdictions?

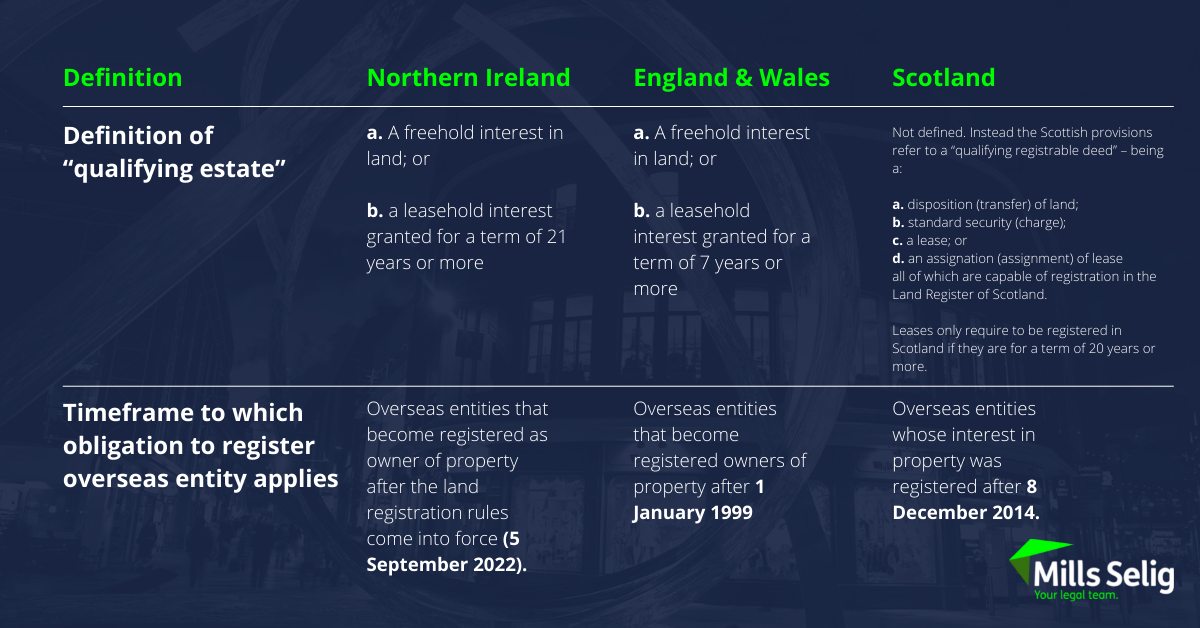

As can be seen from the point above, there are some differences in application of the rules between the UK jurisdictions.

The key differences between corresponding provisions are outlined in the table below:

Failure to comply

As well as restrictions on buying, selling, transferring, leasing or charging property in the UK if an overseas entity is not registered, there are heavy sanctions for any failure to comply with the rules set out in the Act.

These include criminal sanctions, with fines of up to £2,500 a day and prison sentences of up to 5 years.

Prepare for the changes

Overseas entities should start preparing now to register as an overseas entity if any of the following criteria apply:

Northern Ireland

The entity intends to acquire interests in land in Northern Ireland after 5 September 2022.

England & Wales

The entity became the registered owner of qualifying land in England after 1 January 1999; or

The entity intends to acquire interests in land in England after 5 September 2022.

Scotland

The entity became the registered owner of qualifying land in Scotland after 8 December 2014; or

The entity intends to acquire interests in land in Scotland after 5 September 2022.

Or, for any of the UK jurisdictions (if not already caught by criteria above):

The entity has disposed of interests in land in the UK since 28 February 2022; or

The entity intends to dispose of interests in land in the UK prior to or on 31 January 2023.

Next steps

Overseas entities should start preparing now to register as an overseas entity if any of the following criteria apply:

In an overseas entity has not registered in time, the Act will prohibit the transfer, lease or charging of land in the UK.

In addition, if an overseas entity does not register pre-existing interests in qualifying land (in England & Wales and Scotland) and disposals made since 28 February 2022, by the 31 January 2023 deadline, an offence will have been committed.

Once registered in the ROE, overseas entities will need to be diligent in providing an updated statement to Companies House on an annual basis, to avoid criminal sanctions.

Questions?

Mills Selig are here to advise you on the implications of the Economic Crime (Transparency and Enforcement) Act 2022 and specifically how it applies to real estate in Northern Ireland. Please do not hesitate to be in touch with a member of the team if you have any questions.

Editorial prepared by Jayne Paterson, Consultant, Commercial Property @ Mills Selig

If you have any further questions on this topic or require specialist advice, please get in touch with us:

Chris Guy, Managing Partner, Head of Corporate – Chris.Guy@MillsSelig.com

Anna-Marie McAlinden, Partner, Commercial Property and Head of Climate & Energy – Anna-Marie.McAlinden@MillsSelig.com

Jayne Paterson, Consultant, Commercial Property

Jayne has wide-ranging experience acting for private and public sector clients, including acquisitions and disposals, commercial leases and their management (for both landlords and tenants), refinances and supporting corporate transactions.

T: 028 9024 3878

E: Jayne.Paterson@MillsSelig.com

W: www.MillsSelig.com/CommercialProperty